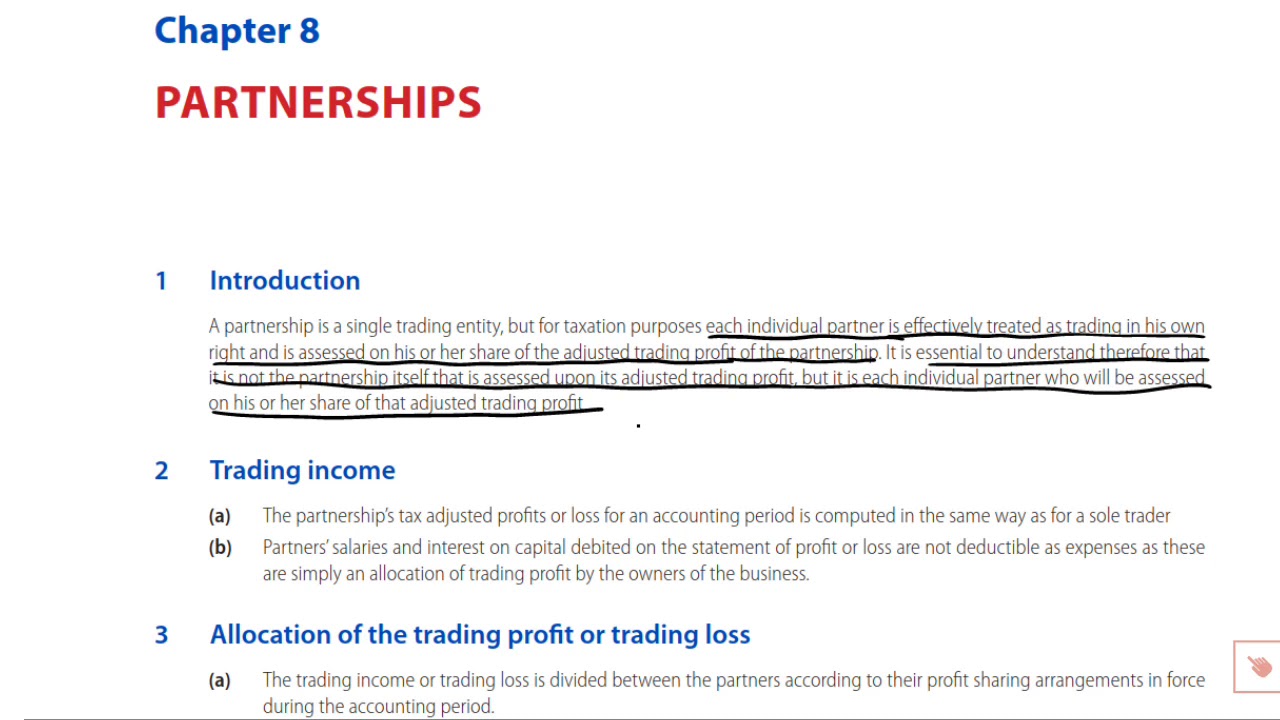

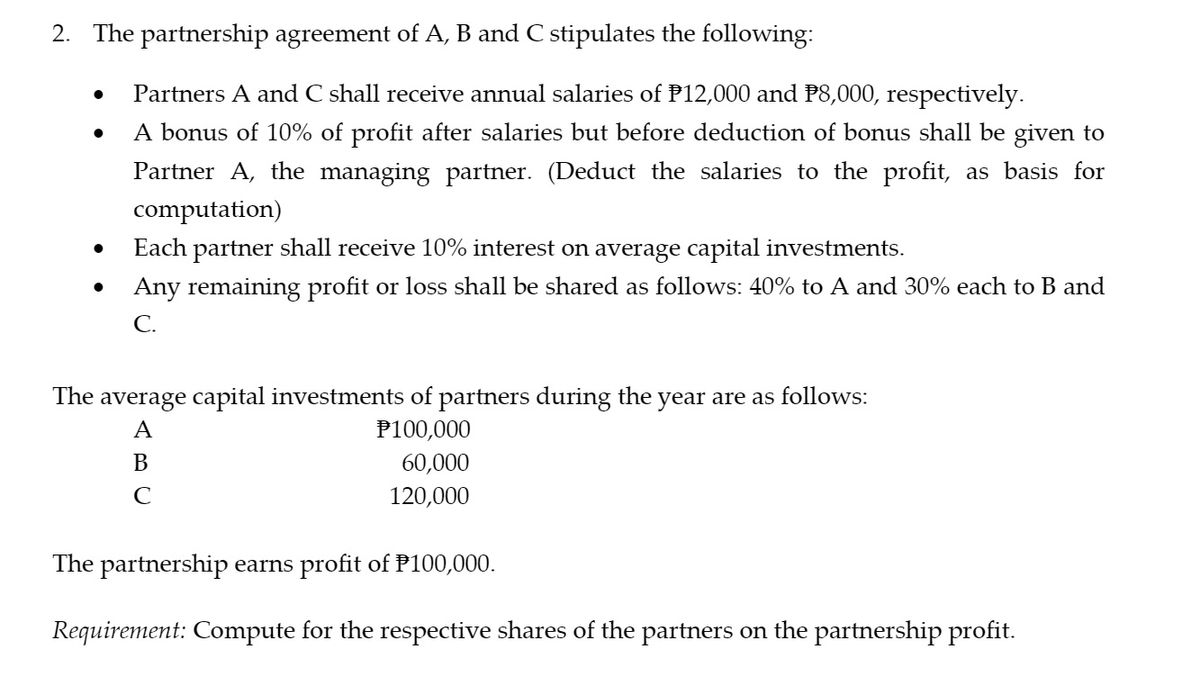

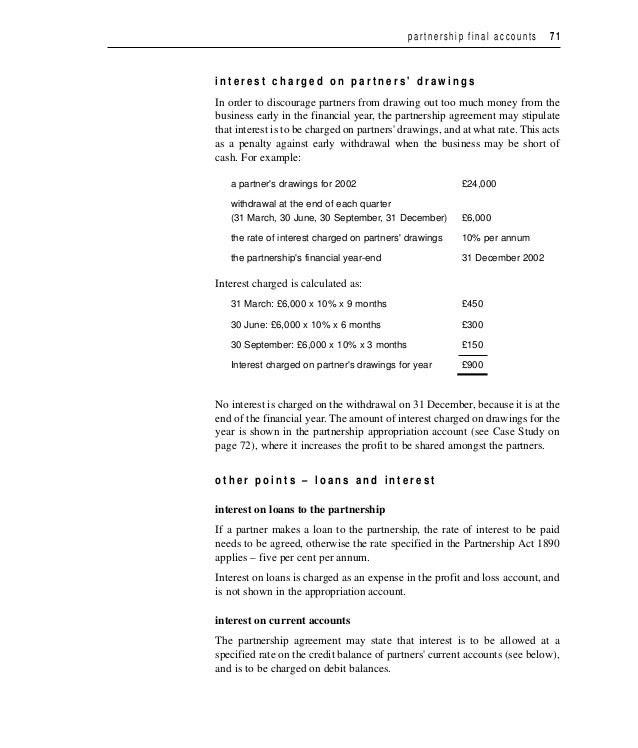

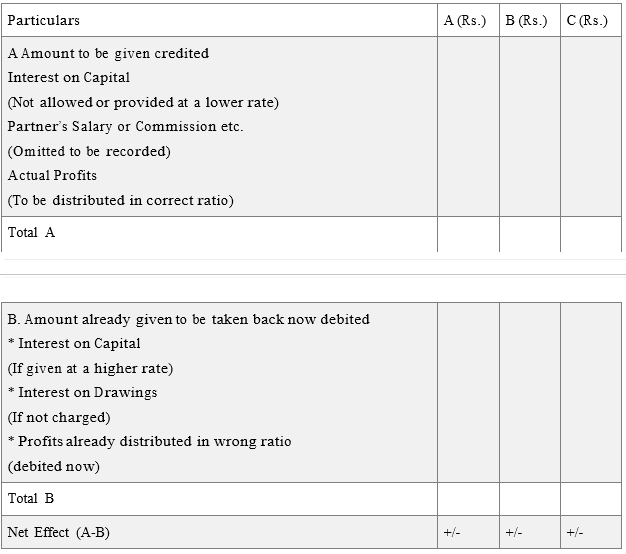

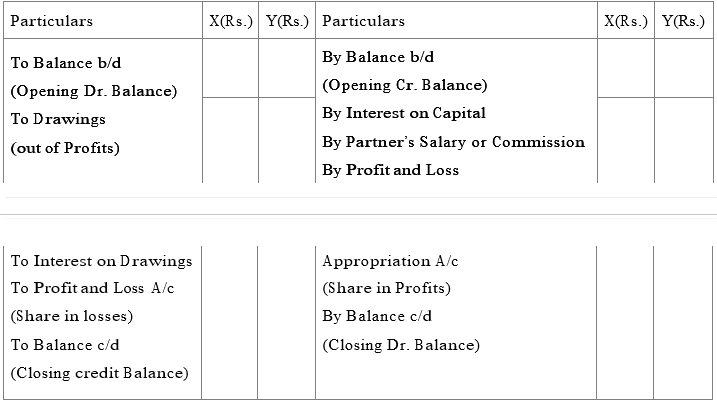

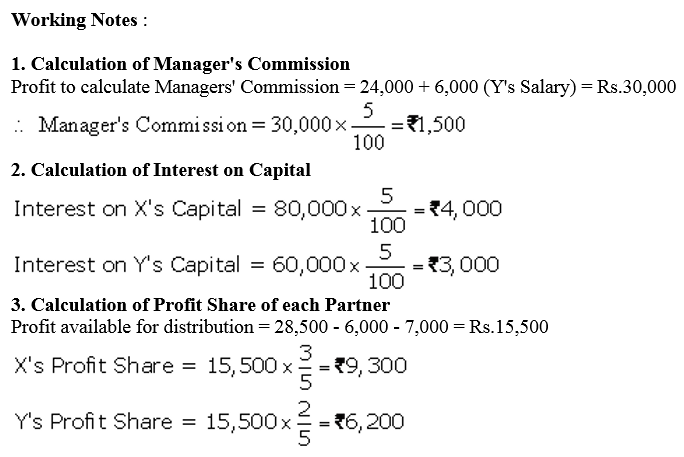

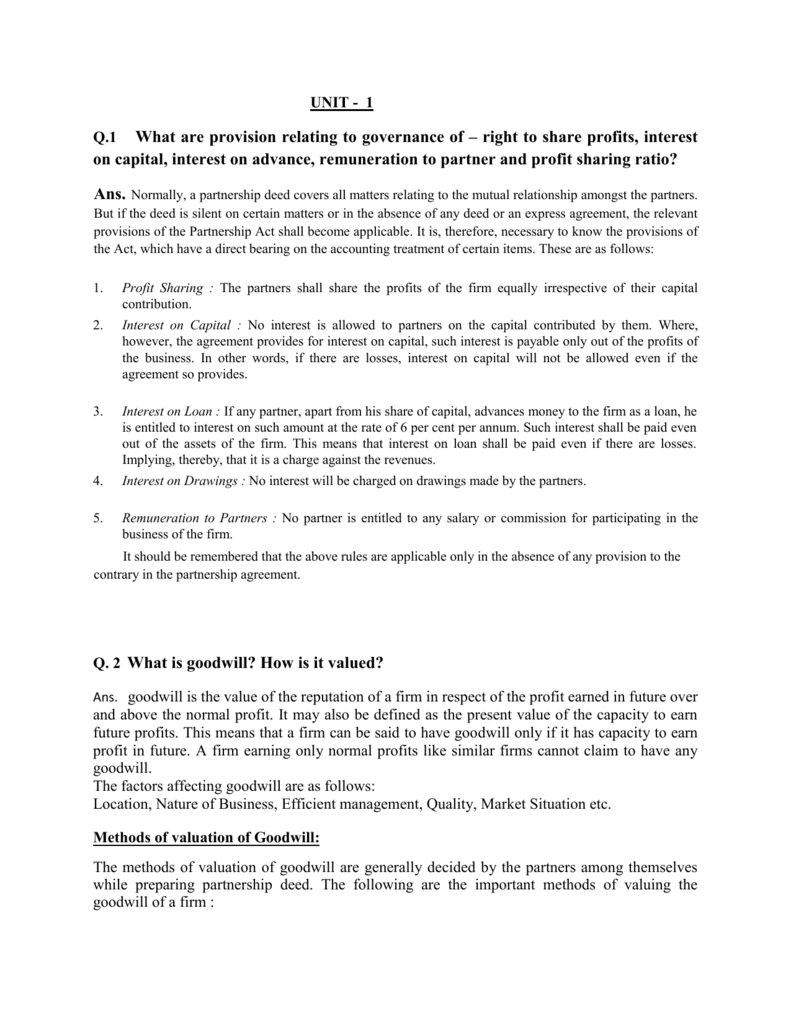

By profit sharing ratio in a partnership firm, we mean the ratio in which the profits and losses of the firm are to be distributed amongst the partners The basis for arriving at the ratio is the agreement between the partners If there is a partnership deed, the ratio should be ascertained from the provisions in the partnership deed Originally posted by CA Abhishek Singh Hello everyone, i have to draft the partnership deed of a firm engaged in the business of construction it has three partners having equal shares i have read the income tax act and one of the conidtion in sec 40b for allowing the remuneration is that "IT SHOULD BE AUTHORISED BY AND IN ACCORDANCE WITH THE PARTNERSHIP DEEDIn a partnership firm, partner A is entitled a monthly salary of Rs7,500 At the end of the year, firm earned a profit of Rs75,000 after charging A's salary If the manager is entitled a commission of 10% on the net profit after charging his commission, Manager's commission will be (A) Rs7,500 (B) Rs 16,500 Rs8,250 (D) Rs 15,000 Answer D

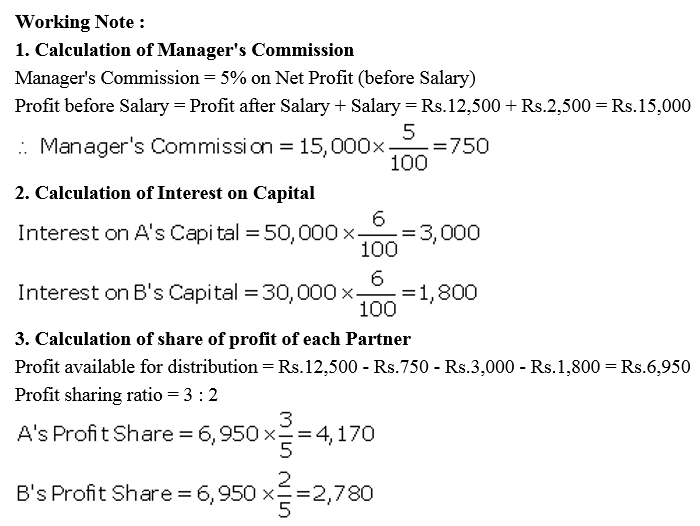

Ts Grewal Solution Class 12 Chapter 2 Accounting For Partnership Firms Fundamentals 19

In absence of partnership deed partners are entitled to how much percent of profit as salary

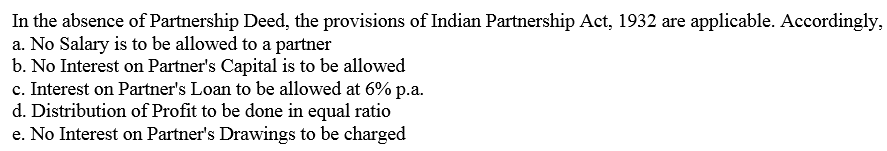

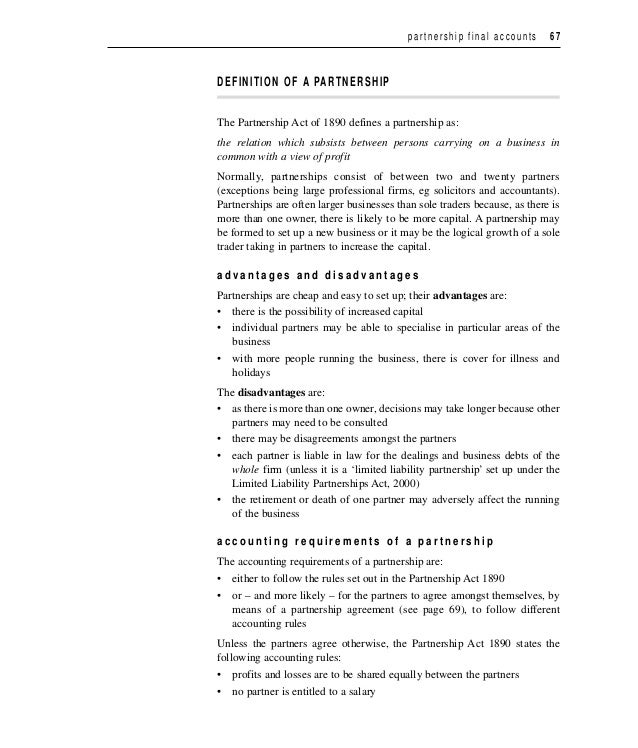

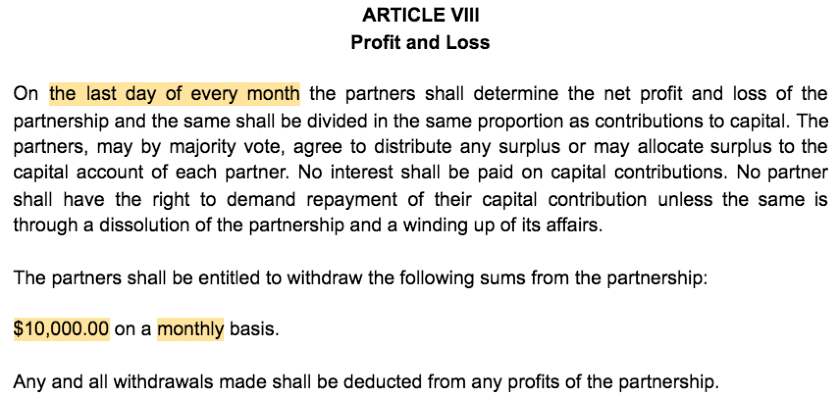

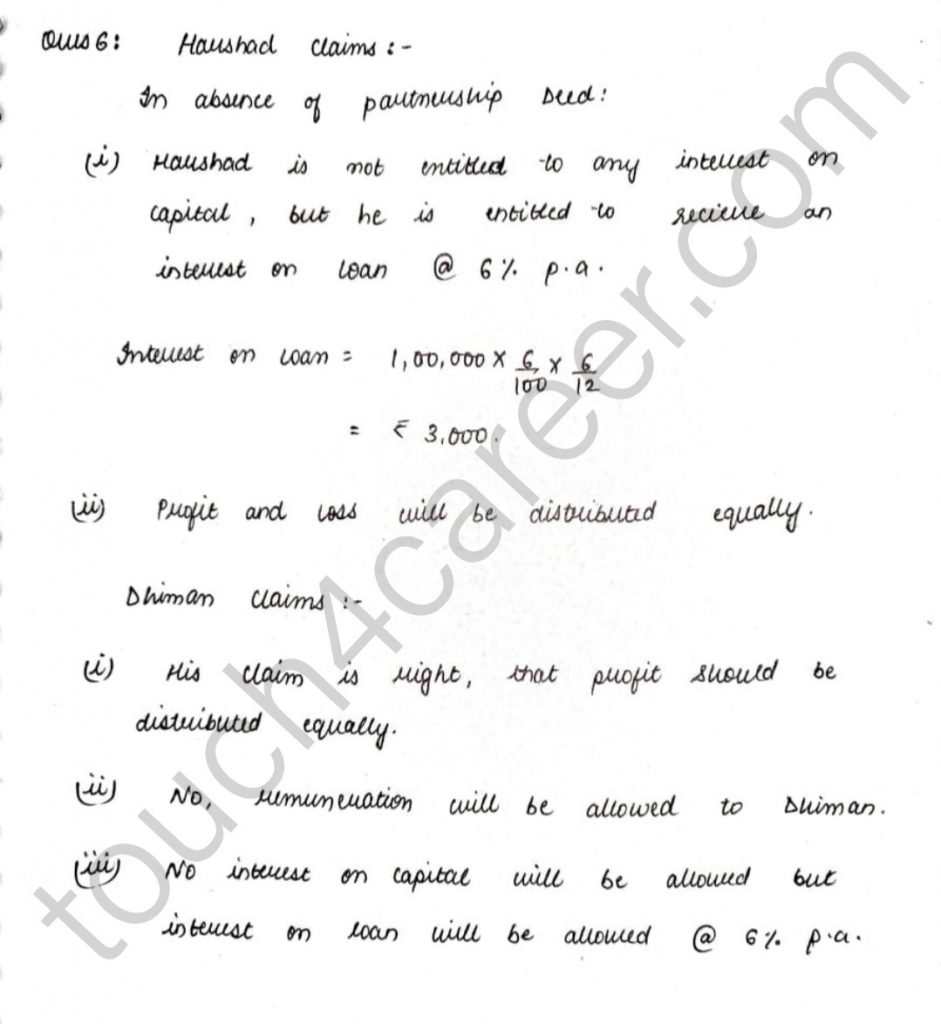

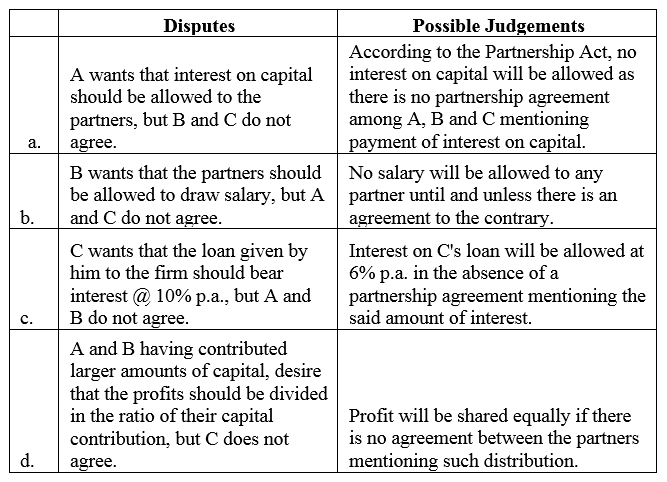

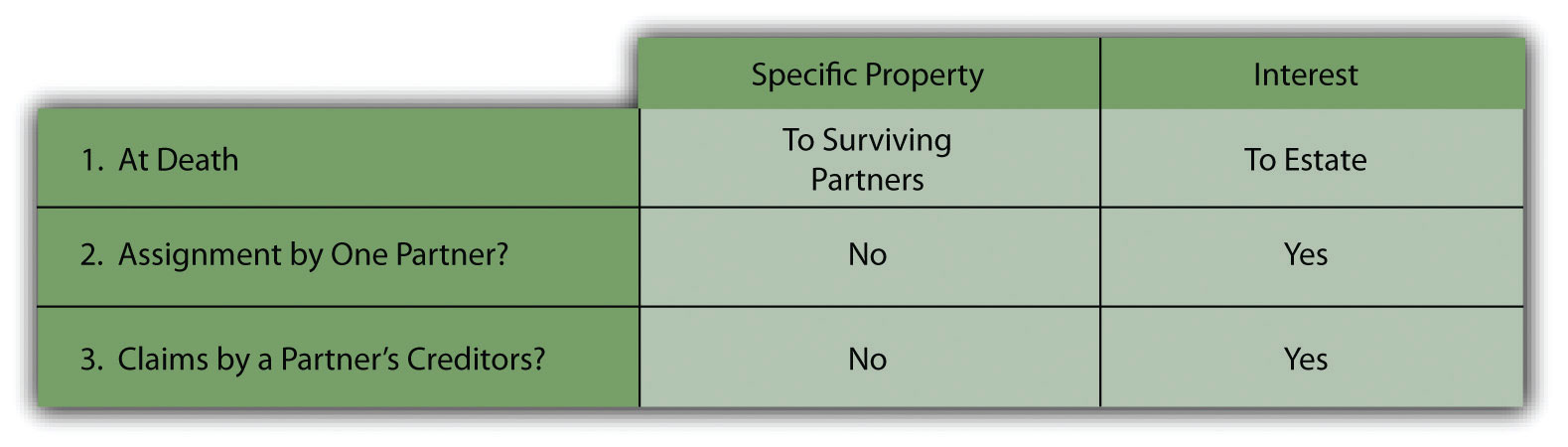

In absence of partnership deed partners are entitled to how much percent of profit as salary-In the absence of an agreement between the partners, a partner is entitled to receive interest at the rate of 6% pa on any payment or advance made beyond the amount of Capital he has to contribute If there is an agreement between the partners then interest is to be paid at the rates agreed upon, Indian Partnership Act, 1932The Partnership Section 6 Profit and Loss 61 Agreement, no Partner shall receive any salary for services rendered to or for the Partnership At the discretion of majority partner the minority partner will be eligible to If two (2) or more Partners of the Partnership desire to accept the Offer to purchase the Offered Interest, then

2

The Partnership Deed created by the partners is required to be made on a stamp paper in accordance with the Indian Stamp Act and every partner must have a copy of the partnership deed A Copy of the Partnership Deed must also be filed with the Registrar of Firms if the firm is being registered Absence of a Partnership Deed If the partners doContents of a Partnership Deed 3 Rules to be Followed in the Absence of a Partnership Deed Meaning of Partnership Deed The partnership comes in existence by an agreement The agreement may be written or oral But it is advisable that a Partnership Agreement or Partnership Deed is drawn up and signed by the partners The neglect of this In the absence of partnership deed or verbal agreement, or if the partnership deed is silent on a certain point, the following provisions of the Indian Partnership Act, 1932 will be applicable PROFIT SHARING RATIO Profits and losses are to be shared equally irrespective of their capital contribution

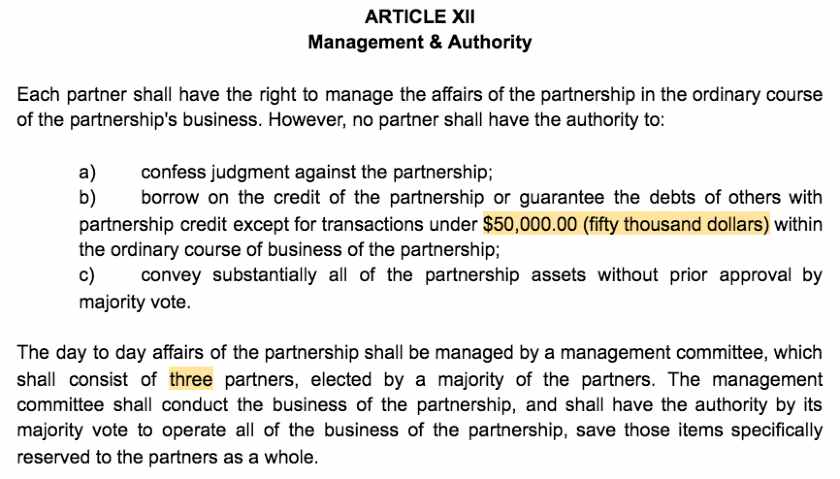

This Partnership Deed describes the partner responsibilities, outlines the ownership interest in the partnership, defines the profit and loss distribution of each partner, prepares the partnership for common business scenarios, and includes other important rules about how the partnership will be managed and conduct business In the absence of partnership deed if partner gives any loan to the firm he/she will be entitled to get fixed percentage of interest @6% of annum (v) Salary of Partner In the absence of the patnership deed a partner will be entitled for getting any salary for his work even ifA partner is entitled to be indemnified for the loss he sufferer in performing any assignment in respect of operation of the company A partner is entitled to the salaries he would receive to operated the business If permitted A partner is entitled to the interest on capita, if allowed by the deed A partner can withdraw money if permitted by

A partnership deed or mong partners in a partnership business in which the rights and obligations of each partner is made clear The partnership deed is then signed by a solicitor The main purpose of a partnership deed is to show the rights and obligations of each partnerPartners are entitled to interest on capital @ 8% per annum and salary to Chaman and Dholu @ Rs7,000 per month and Rs10,000 per quarter respectively as per the provision of the Partnership Deed Dholu's share of profit (excluding interest on capital but including salary) is guaranteed at a minimum of Rs1, 10,000 paIf anything is not mentioned, then the relevant provision of Partnership Act, 1932 will be applicable The partnership deed should contain the following points Name and Address of the Firm Names and Addresses of the Partners Nature of Business It should be unanimously decided by the partners what type of business they will be carrying on

Ts Grewal Solutions For Class 12 Accountancy Accounting For Partnership Firms Fundamentals Cbse Tuts

2nd Puc Accountancy Question Bank Chapter 2 Accounting For Not For Profit Organisation Kseeb Solutions

That the net profit of the partnership firm after deduction of all expenses including rent, salaries, other establishment expenses, interest and remuneration payable to the partners in accordance with this deed of partnership or any supplementary deed as may be executed by the partners from time, to time, shall be divided and distributed(ii) No partners are entitled to any sort of salary or remuneration when there is no agreement (iii) Here, if there is no agreement between the partners only 6% will be allowed to partner's loan and no interest in a partner's capital Partners liability is unlimited in a general partnership however, if it is a limited liability partnership, at least one partners will be liable for all debts as per the partnership act InDeed it should be clearly defined about each partner liability status In the absence of it, it would be assumed all partners are liable 5Profit and loss

Ts Grewal Solution Class 12 Chapter 2 Accounting For Partnership Firms Fundamentals 19

Distribution Of Profit In A Partnership Explanation Examples Finance Strategists

Partner % of share in Profits and Losses 9 That the partners will be paid a Salary of Rs2500/ per month for the services rendered to the rim and they will also be entitled to a bonus @ 12% on their salaryEduRev Commerce Question is disucussed on EduRev Study Group by 1237 Commerce StudentsAnswer (1 of 3) Looking at what you have commented, there is a couple of things you need to absolutely do as quickly as you can before going forward If you don't, you will finding yourself disputing with your partners and maybe even causing your company to

Important Questions For Cbse Class 12 Accountancy Past Adjustments And Guarantee Of Profits To A Partner

Sec Filing Micron Technology

Partnership deed is an agreement between the partners of a firm that outlines the terms and conditions of partnership among the partners A Partnership is the relation between persons who have agreed to share profits of the business carried on by all or any of them acting for all An Agreement is the essential part of partnership business as it Hence if a firm is not having any written agreement or a partnership deed or if partnership deed is there but it is silent on certain issues the following provisions of the Indian Partnership Act 1932 will be applicable 1 Profit sharing Ratio Profits and losses would be shared equally among partners 2 There is no one clear answer for what a good profitsharing percentage is for all businesses How many partners you have, how much work each partner does, the experience they bring to the table, and how much money each partner has invested in the business will likely play a factor in how you split up profits

General Partnerships Explained The Business Professor Llc

In The Absence Of Any Provision In A Partnership Deed At What Rate Is A Working Partner Entitled For Remuneration Quora

Partnership deed is an agreement or contract signed by all the partners on variety of issues such as main business purpose, profit sharing ratio, interest on partner's capital, salary, bonus, commission or remuneration for partners, rights and obligations of members and rules about its day to day operations Sep 29,21 In the absence of partnership deed, the profit will be divided among partners a In the capital ratio b In equal ratio c In any ratio d Not in any ratio?Answer All partners in the old profit sharing ratio In the absence of Partnership Deed (A) Interest will not be charged on partner's drawings (B) Interest will be charged @ 5% pa on partner's drawings Ques In the absence of agreement, partners are not entitled to (A) Salary (B) Commission Equal share in profit

Form S 1

Profit And Loss Appropriation Account Accountancy Knowledge

In case of partnership deed is silent then section 2 of the Partnership Act 1932 will apply according to the Section partners are not provided with remuneration it is clearly mentioned that unless there is an agreement between the partners to the contradiction of section the partners are not eligible to have a remuneration for their contribution towards the firm moreover they cannot demand even interest on capital however there is a provision for loan by the partner which is 6% per annum8 Division of Profit Profit and loss sharing ratio should be stated in the deed If it is not mentioned partners are authorized to share equally according to Partnership Act 9 Partners' Salary and Commission If the partners decide to pay salary and commission to the partners, the deed should contain the amount of salary or commission payable to any partner for the services Therefore, amendment in partnership deed made now, in tune with amendment in Incometax Act,1961 wref should be accepted by the AO and it is expected that the AO shall not dispute amount of distributable profit on the basis of amendment for whole of the year In view of the author the AO shall have no such right to dispute

Accounting For Partnership Notes Class 12 Accountancy

Covid 19 And The Tough Questions Law Firms Are Now Asking Fivehundred

Partnership deed also defines a remuneration or salary of the partners and working partners However, interest is paid to each partner who has invested capital in the business Also Check The importance of the Partnership Agreement The above mentioned concept about Partnership Deed is explained in detail for Class 12 studentsThat all the WORKING PARTNERS may be paid Salary wef 1 St day of March of , NAME OF WORKING PARTNER SHARE OF PROFIT That the terms of the Partnership Deed may be altered, added to or cancelled by the written consent of the Parties to this DEED (i) Sharing of profits and losses If the partnership deed is silent on sharing of profit or losses among the partners of a firm, then according to the Partnership Act of 1932, profits and losses are to be shared equally by all the partners of the firm (ii) Interest on partner's capital If the partnership deed is silent on interest on partner's capital, then according to the Partnership

Ts Grewal Solutions For Class 12 Accountancy Accounting For Partnership Firms Fundamentals Cbse Tuts

Partnership Accounts

Hence if a firm is not having any written agreement or a partnership deed or if partnership deed is there but it is silent on certain issues the following provisions of the Indian Partnership Act 1932 will be applicable 1 Profit sharing Ratio Profits and losses would be shared equally among partnersPartnership Deed A document which contains details of an express written agreement between the partners is called Partnership DeedAn association of persons who join as partners is known as 'partnership firm' and a 'partner' is a person who is associated with another person(s) to carry on a business and share its profits in an agreed ratioClause1 – Date of Agreement All the partners have solemnly agreed upon to this indenture of partnership, with effect from forenoon of the 8th day of May, 19 Clause2 – Name and Title of the Firm The name and style of the partnership firm shall be M/S NAMEThe same may be changed as and when necessary by mutual agreement by the partners

Important Questions For Cbse Class 12 Accountancy Past Adjustments And Guarantee Of Profits To A Partner

12 The Partnership Act 1932 Business Law Dev Guis

The Cleardocs Partnership Agreement allows for partners to be paid a fixed draw from the partnership's profits This works similarly to a salary, but better reflects the partnership structure The Cleardocs Partnership Agreement provides that the partners of the partnership must contribute towards the capital of the partnership, and share in 6 The partners shall be entitled to modify the above terms relating to remuneration, interest etc, payable to the partners by executing a supplementary deed, and any such deed when executed shall have effect, unless otherwise provided, from the first day of the accounting period in which such supplementary deed is executed and the same shall form part of this deed of partnership In the absence of partnership deed, the partner will be allowed interest on the amount advanced to the firm (a) @5% (b) @6% (c) @ 9% (d) @8% Answer Answer (b) @6%

General Partnerships Explained The Business Professor Llc

General Partnerships Explained The Business Professor Llc

Profit and losses are to be shared equally irrespective of their capital contribution No interest on capital shall be allowed to the partners No interest on drawing will be charged No partner is entitled to get the salary for his work done for the business Interest at the rate of 6% per annum is to be allowed on a partner's loan to the business Such interest shall be paid even there Relevant Statute in the absence of Partnership Deed Following are some of the rules applicable to all the partners if the partnership deed is not prepared Proportionate allocation of profits No interest on capital is provided to any partner No interest on drawings is given No salary or commission is granted Immediately after signing the accounts each partner shall be entitled to draw out and receive his share of profit and loss of the business for that year 9 That if any partner opts to retire from the partnership business he may give _____ month notice thereof in writing to the other partner

Allocating Partnership Profits To Partners Acca Taxation Tx Uk Exam Fa19 Youtube

Answered The Partnership Agreement Of A B And C Bartleby

A isentitled to a salary of Rs24,000 per annum and B is entitled to a salary of Rs18,000 per annum Theyhave withdrawn 50% of their salaries during the year A and B are entitled to commissions at the rate of5% and 3% respectively on the net profit after salaryNet profit during the year 02 before partner‟s salary amounted to Rs84,000 23 In the absence of partnership deed, the following rule will apply (A) No interest on capital (B) Profit sharing in capital ratio Profit based salary to working partner (D) 9% pa interest on drawings Answer Answer A Partnership deed, salary not mentioned Running a partnership firm, deed does not specify any salary to partners though both working, whereby provision of execution of supplementary deed exists But by grace of god, business plunged to profits in Financial year showing profit 45 lks without deducting expenditures yet

Reform Of Banking Laws And Regulations In Iran In Reform Of Banking Laws And Regulations In Iran

1

3 Salary/ Commission to partner No partner is entitled to salary/ commission from the firm, unless the partnership deed provides for it 4 Interest on loan If any partner, apart from his share capital, advances money to the firm as loan, he is entitled to interest on such amount at the rate of six percent per annum 5Note In the absence of agreement between the partners, the Partnership Act 1932 will apply accordingly, 1 No interest is provided on partners Capital in the absence of Partnership Deed 2 Partners are entitled to interest @ 6% pa on loans advanced to The assessee was a partnership firm which amended its partnership deed in the assessment year 0910 wef quantifying the salary of the partners The salary to the partners in the unamended partnership deed dated was specified to be in the ratio of profitsharing limited to maximum allowable under Income Tax Act, 1961

Splitting The Pie Some Thoughts On Profit Sharing Among Partners Edge International

Partnership Rules Faqs Findlaw

(i) Sharing of profits and losses If the partnership deed is silent on sharing of profit or losses among the partners of a firm, then according to the Partnership Act of 1932, profits and losses are to be shared equally by all the partners of the firm (ii) Interest on partner's capital If the partnership deed is silent on interest on partner's capital, then according to the Partnership

Section 40 B Deduction For Salary And Interest Partnership Business

Ts Grewal Solutions Archives Page 3 Of 5 Ncert Books

How To Create A Business Partnership Agreement Free Template

State The Provisions Of Indian Partnership Act Regarding The Payment Of Remuneration To A Partner For The Services Rendered From Accountancy Accounting For Partnership Basic Concepts Class 12 Cbse

X And Y Are Partners In A Firm X Is Entitled To A Salary Of Rs 10 000 Per Month And Commission Of 10 Sarthaks Econnect Largest Online Education Community

Partnership Accounts

Accounting For Partnership Basic Concepts Popular Questions Icse Class 12 Commerce Accountancy Partnership Accounts Meritnation

1ocjuxvte0uukm

Ts Grewal Solution Class 12 Chapter 2 Accounting For Partnership Firms Fundamentals 21

2

Profit And Loss Appropriation Account Accountancy Knowledge

Accounting For Partnership Notes Class 12 Accountancy

2

Ts Grewal Solution Class 12 Chapter 2 Accounting For Partnership Firms Fundamentals 19

Partnership Accounts

Caught Between Conscience And Career Expose Abuse Without Exposing Your Identity

1ocjuxvte0uukm

Capitals Gains Tax On Separation Low Incomes Tax Reform Group

Fundamentals Of Partnership Accounts And Goodwill Chapter1 And Chapter2 Notes

A And B Are Partners In A Firm A Is Entitled To A Salary Of Rs Per Month Accountancy Accounting For Partnership Basic Concepts Meritnation Com

1

Dk Goel Solutions Class 12 Chapter 2 Free Study Material

In The Absence Of An Agreement Partners Are Entitled To

How Does The Profit Sharing Work Among Partners In A Pvt Ltd Company Quora

1 Omfofjnxtcnm

How To Create A Business Partnership Agreement Free Template

What Is A Partnership Agreement Insights Alston Asquith

Accounting For Partnership Notes Class 12 Accountancy

Ts Grewal Solution Class 12 Chapter 2 Accounting For Partnership Firms Fundamentals 19

All You Need To Know About The Indian Partnership Act 1932

Asif And Ravi Are Partners In A Firm Sharing Profits And Losses In The Ratio Of 3 2 Their Fixed Capitals As On 1 St April 16 Were Rs 6 00 000 And Rs

Partnership Deed Q 1 Q 6 Ch 2 Ts Grewal S 21 Class 12th

Distribution Of Profit In A Partnership Explanation Examples Finance Strategists

Profit And Loss Appropriation Account Accountancy Knowledge

Accounting For Partnership Notes Class 12 Accountancy

Ts Grewal Solutions Archives Page 3 Of 5 Ncert Books

Remuneration To Partners In Partnership Firm Under 40 B

Dk Goel Solutions Class 12 Chapter 2 Free Study Material

1

Rights Of Partner As Per The Indian Partnership Act 1932

2

Rights And Duties Of Partners In Partnership Online Indiafilings

2nd Puc Accountancy Question Bank Chapter 2 Accounting For Not For Profit Organisation Kseeb Solutions

Blueprint

/GettyImages-1152013583-a5bad8090c064339bf7880b7c9012379.jpg)

Which Terms Should Be Included In A Partnership Agreement

1

Ts Grewal Solution Class 12 Chapter 2 Accounting For Partnership Firms Fundamentals 19

Important Questions For Cbse Class 12 Accountancy Profit And Loss Appropriation Account

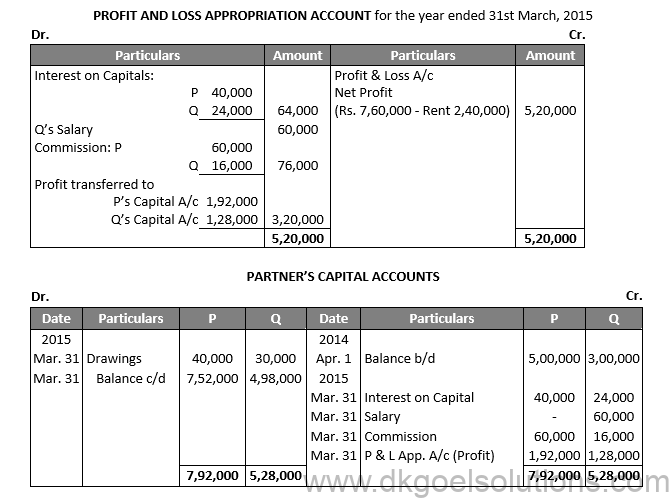

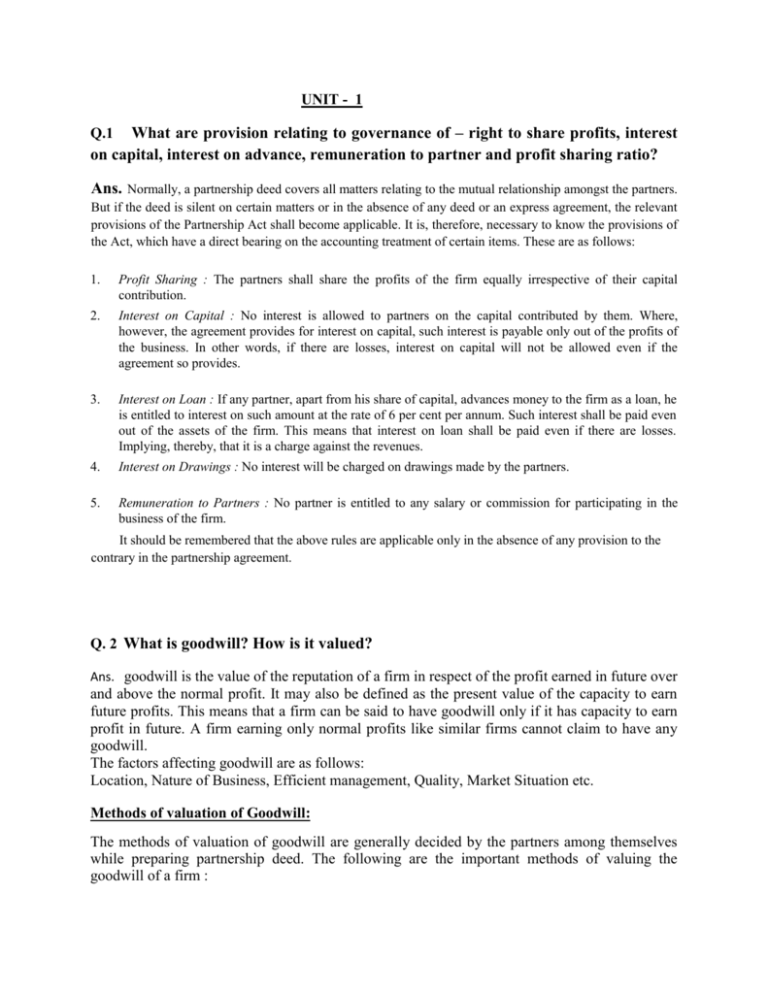

Q 1 What Are Provision Relating To Governance Of Right To Share

Accounting For Partnership Notes Class 12 Accountancy

X And Y Are Partners In A Firm X Is Entitled To A Salary Of Rs 10 000 Per Month And Commission Of 10 Sarthaks Econnect Largest Online Education Community

Partnership Accounts

How To Balance Bank Holidays And Keep All Of Your Partners Happy

2

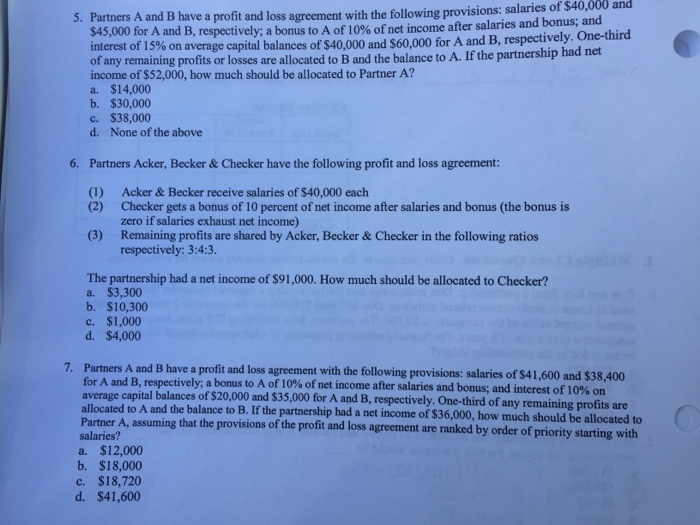

Solved Partners A And B Have A Profit And Loss Agreement Chegg Com

Leading Blog A Leadership Blog

2

Partnership Deed Its Importance And Rights Of Partners Accounting Finance

2

Selling Your Home Low Incomes Tax Reform Group

Distribution Of Profit In A Partnership Explanation Examples Finance Strategists

Distribution Of Profit In A Partnership Explanation Examples Finance Strategists

Interest Remuneration To Partners Section 40 B

Page 53 Debk Vol 1

Ts Grewal Solutions Archives Page 3 Of 5 Ncert Books

The Corporation And Its Capital Part Ii Comparative Company Law

Profit And Loss Appropriation Account Accountancy Knowledge

Tax Treatment Of Partnerships Taxation

Ts Grewal Solutions Archives Page 3 Of 5 Ncert Books

2nd Puc Accountancy Question Bank Chapter 2 Accounting For Not For Profit Organisation Kseeb Solutions

The Corporation And Its Capital Part Ii Comparative Company Law

S 1 A 1 2456zs 1a Htm S 1 A Use These Links To Rapidly Review The Document Table Of Contents Contents Table Of Contents As Filed With The Securities And Exchange Commission On July 17 Registration No 333 United States

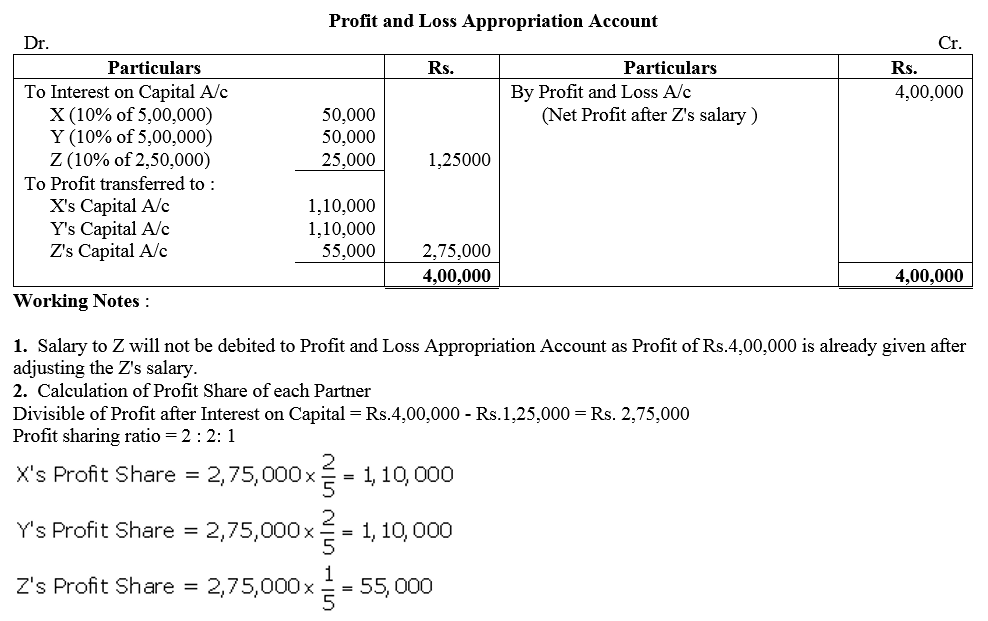

X Y And Z Are Partners In A Firm Sharing Profits In 2 2 1 Ratio The Fixed Capitals Of The Brainly In

Rights And Responsibilities Of Partners In A Partnership Firm Legalwiz In

Partnership Accounts

Profit And Loss Appropriation Account Accountancy Knowledge

Q 1 What Are Provision Relating To Governance Of Right To Share

Ts Grewal Solutions Archives Page 3 Of 5 Ncert Books

Operation Relations Among Partners

Distribution Of Profit In A Partnership Explanation Examples Finance Strategists

0 件のコメント:

コメントを投稿